Explainer : What is Helicopter money proposed by CM KCR ?

By Newsmeter Network

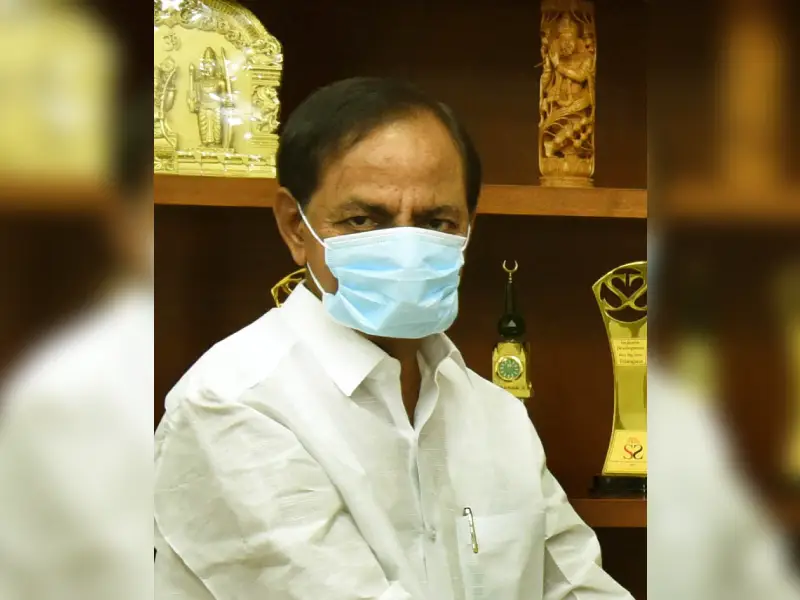

Hyderabad: The COVID-19 pandemic has hit the world economy and now strategists are chalking out plans to revive it. Amidst this, Telangana Chief Minister K. Chandrasekhar Rao has advised the Reserve Bank of India to adopt the concept of "helicopter money".

Chief Minister KCR, in a press conference, said, “To counter the economic crisis the RBI should implement quantitative easing policy. This is called helicopter money. This will facilitate the states and financial institutions to accrue funds. We can come out of the financial crisis.”

In a letter addressed to the Prime Minister CM K Chandrashekar Rao, proposed several strategies to boost the economy. He said , In 1918 due to Spanish Flu, there was an economic crisis all over the world. In 2008 there was an economic recession all over the globe. Due to proper measures we should get over it. Even now we are facing financial problems. To counter this we need a strategic economic policy. RBI should implement quantitative easing policy. This is called 'Helicopter money'. This will facilitate the States and financial institutions to accrue funds. We can come out the financial crisis. Release 5 per cent of funds from the GDP through Quantitative easing Policy'.

But, what is Helicopter money?

The term ‘helicopter money’ was first coined by American economist Milton Friedman. According to him, helicopter drop or helicopter money is a last resort to spurt the economy by increasing the money supply. In layman’s term, it means the Central banks will print more money and dump it in the market in order to increase inflation and will let the spending increase thus bringing back the economy to normal. But this concept is only theoretical and has not been used.

The industry body, CII, also suggested that direct cash of Rs. 5,000 should be transferred to the accounts of all adults with an annual income of less than Rs. 5 lakhs. It said that this would be a temporary one-time boost to increase consumer demand.

But, the possibility of money drop doesn't seem to be a realistic task according to C. Ramchandraiah, a professor at the Centre for Economic and Social Studies (CESS). He explained , “How will the government identify such bank accounts? Those most affected by the lockdown are daily wage labourers, taxi drivers, small scale vendors, and people working in malls. Will their bank account numbers be collected? If yes, then how? There are several things that the government has to decide before coming out with such a plan.”

Giving way to another possibility to revive the economy , Mr. Devender Pant – Economist, suggested, “During economical crisis and uncertainty like the current times. Governments lose revenue in form of ‘no taxes’ because of no production. On certain conditions, RBI can subscribe to government borrowing. If needed, RBI can purchase government bonds and support them financially."