Can bull rally sustain on D-Street?

By Sreenivasa Rao Dasari

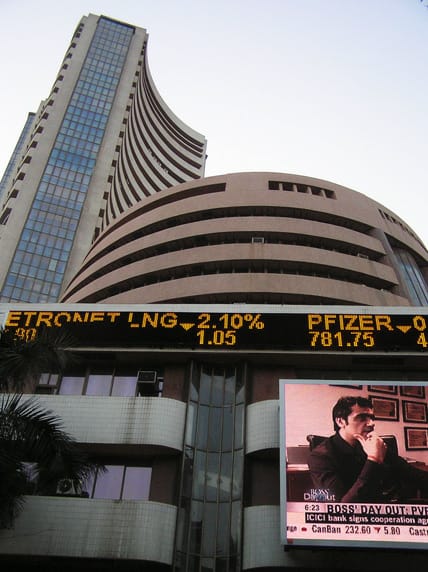

Hyderabad: The domestic bourses gave a thundering response to the large stimulus package announced by the Centre on Friday. The stock markets were sluggish due to FPI outflows since the Union Budget disappointed the investors in July. However, the latest announcement by the Union Finance Minister Ms Nirmala Sitharaman boosted the market sentiment. The market barometer BSE Sensex vaulted by 1,921.15 points or 5.32 per cent, to end the session at 38,014.62 points. Similarly, NSE Nifty closed at 11,274.20 points, a net gain of 569.40 points or 5.32 per cent. Now, the major question is whether it’s sustainable? The answer seems to be positive for investors.

Why will the Bullishness Continue?

With the latest cut in corporate tax, Indian tax rates have become more or less similar to China and other Asian nations. The lower corporate tax will attract foreign portfolio investors (FPIs). Adding to this, speculators and bulls wouldn’t be satisfied with five per cent gain on a single day. With returning FPI inflows, the markets may continue to grow further. The cut in interest rates and other stimulus announced by the Centre, the corporate activity is expected to witness a revival in the quarters to come. With these factors in place, the stock market bull-run is more likely to continue for some more time, observe analysts.

“Once the benefit of corporate tax cut materialises, then we can have another round of bull-run. FPIs will come back to Indian markets. The return of FPIs will enhance Capex in the Indian corporate sector and consumption in the market. Hence, we can see better corporate earnings in the quarters to come,” observes a market expert.

Sensing that ‘animal spirits’ could be back, experts forecast further upward journey of key indices in the days to come.

Investors richer by Rs7 lakh cr

The unexpected stimulus-led rally of over five per cent resulted in a whopping surge in market capitalisation (m-cap). The m-cap on BSE rose to Rs145.36 lakh crore on Friday as against Rs138.54 lakh cr on Thursday. Investors are richer by Rs6.82 lakh crore in a single day.