11 bank officers convicted by CBI in one month

By Amritha Mohan Published on 11 Feb 2020 4:15 AM GMT

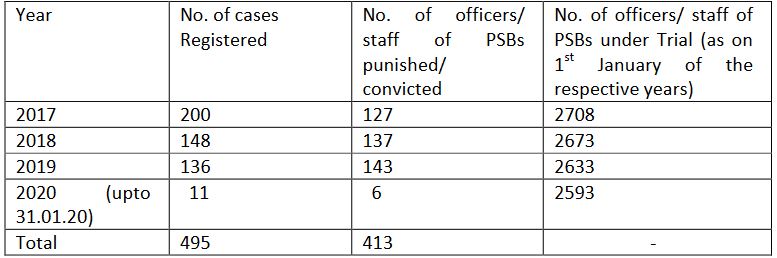

Hyderabad: One month into 2020 and already 11 cases have been registered by the CBI against officials of public sector banks (PSBs). According to the data, more than 2, 500 officers and staff members of public sector banks are undergoing trial in courts as of 31 January 2020.

The data, revealed in response to a question posed in the Lok Sabha, further showed that the Central investigative agency had sought sanction for the prosecution of 801 bank officials. However, the CBI’s request was declined and the cases will be held under consultation with the Central Vigilance Commission (CVC).

More than 2,500 cases have been on trial since 2018 and the numbers have not decreased in 2019. In 2019, among the 136 cases registered, 143 were convicted, while in 2018 among 148 cases registered, 137 officials were convicted. However, the number of ongoing trials have reduced to 2,633 from 2,673 cases, with only 40 cases being resolved over a year. The trend shows that the majority of such cases have gone to trial with no judgements being passed.

Speaking about corruption in the banking sector, M. Padmanabha Reddy from the Forum for Good Governance, Hyderabad, said, “Several of the irregularities in public sector banks date back to the 70s during the Indira Gandhi era. Even in the case of the Lepakshi Knowledge Hub scam, the Andhra government had given around 800 acres of land as a mortgage, which is illegal. Moreover, bank officials get a commission when they turn a blind-eye towards loan defaults by prominent people. Basically, it is a nexus between the bankers, the government, and industries that have led to such corruption.”

The ministry of finance, in response to the Lok Sabha question, said, “Banking corruption and occurrence of frauds was enabled by lack of discipline in the financial system and a lax credit culture across various stakeholders. The role of bankers, too, was not rigorously examined earlier and auditors were not independently regulated.”