Fact check: Is Centre introducing new law to control debts incurred by states? Here's the truth

A post claiming that a new law is being introduced by the Central government to control the debts incurred by the states is being widely shared on social media.

By Newsmeter Network

Hyderabad: A post claiming that a new law is being introduced by the Central government to control the debts incurred by the states is being widely shared on social media.

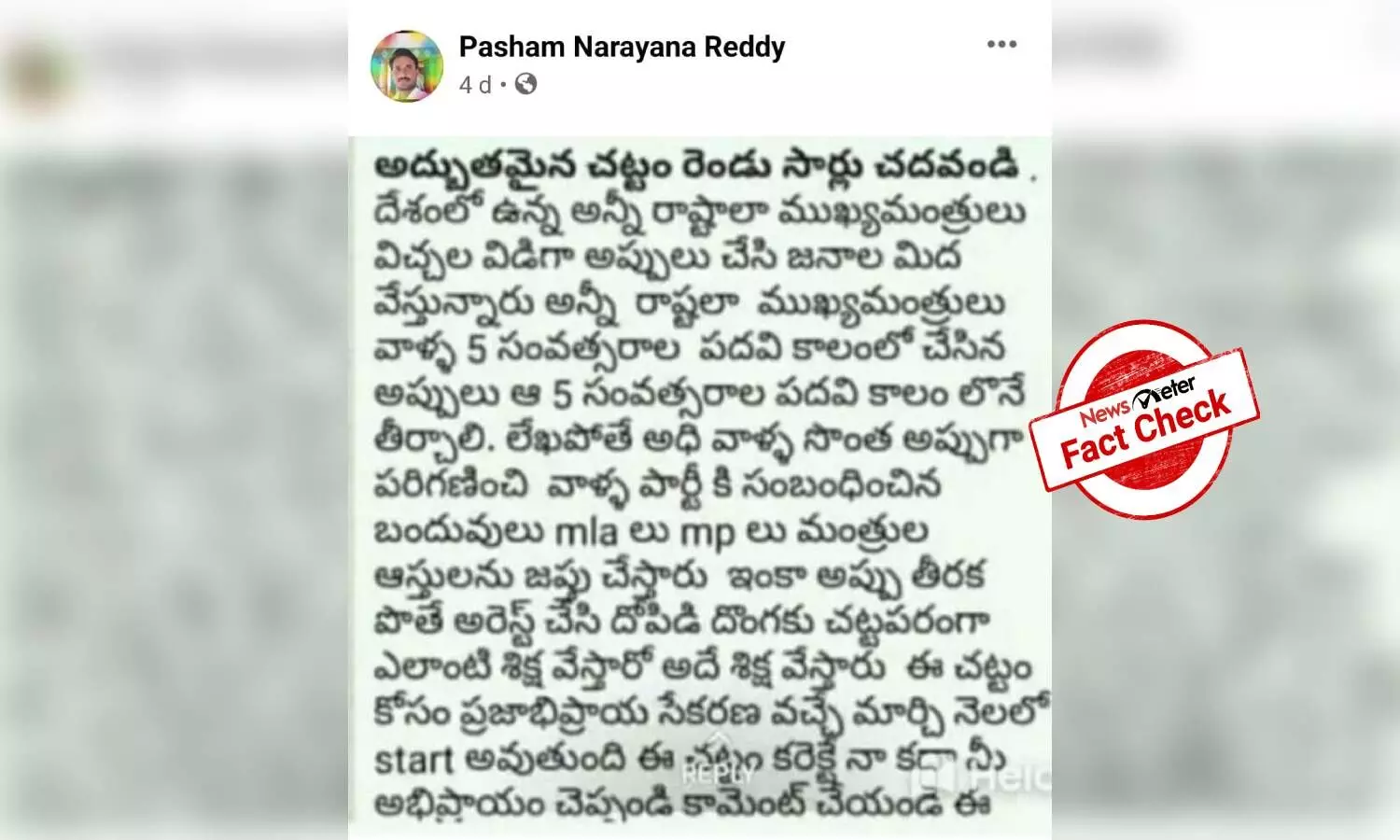

The claim, originally posted in Telugu, reads, "Chief Ministers of all the states are incurring debts and burdening the people. So, if the chief ministers do not repay the debts incurred during their five-year tenure, it will be considered as their own debt and their party relatives, MLAs, MPs, and ministers will be arrested if the debt is not paid." It further adds that a law is being enacted to impose the same.

Click here to view the post.

Fact Check:

The claim is false.

NewsMeter searched the Internet for any news about such a law being enacted but found no information.

However, we did find that the viral claim has been circulating since 2018. Posts with the same claim that were doing the rounds in 2018 can be found here and here.

If there was a referendum or any such proposal as the post claims, news organizations would have reported it but we did not find any such reports. The post claims that a referendum will be held in March from 2018 but so far no such referendum has taken place.

In fact, governments' lack of financial control has become more frequent in recent times. Some of the state and national budgets have to be spent on paying interest on debts. Spending on such unproductive items rather than on infrastructure design is likely to have an impact on the economy in the long run.

Even the Central government is not beyond that. The Centre's debt is also rising due to a lack of financial control and the fiscal deficit percentage in GDP is crossing the threshold. In October 2021, The Print had reported that due to COVID-19 and policies put in place to respond to it, the global debt has reached a record high of US$ 226 trillion. India's dues, it said, is projected to rise to 90.6 per cent in 2021.

The debts incurred by the governments as stated in the post will not be repaid from the own assets of the people's representatives. The debts will always be paid from the public treasury. Let us look at the rules followed by the governments with regard to the debt affairs of the state or Central governments.

Expenditure is usually higher than government revenue in the budgets introduced by governments each year, and there is a big difference between the two. If the expenditure exceeds the budget as compared to the revenue, the difference is considered as fiscal deficit. Governments cover this deficit through debt. However, as the Central and state governments borrow each year to cover this fiscal deficit, the debt owed by governments increases and has an impact on the economy.

However, the then Central government had enacted the Fiscal Responsibility and Management Act 2003 (FRBM) in 2003 to keep the economy under control so that governments do not incur arbitrary debt. The Act imposes restrictions on the fiscal deficit percentage of the Central and state GDP (gross domestic product) and the percentage of debt in the GDP. However, in 2017, a committee was set up to review the law, which set out some of the financial constraints on financial regulations. The present government is following the recommendations of this committee. Some of the limitations proposed by this committee can be seen below.

The Central government should take appropriate steps to reduce the fiscal deficit to 0.3% of GDP every year and limit the fiscal deficit to 2.5% of GDP by 31 March 2023.

The Central government should try to ensure that general government debt (Central and state government debt) does not exceed 60% of GDP.

The Central government should try to ensure that Central government debt does not exceed 40% of GDP by the end of 2024-25. Also, state government debt should not exceed 20% of GDP.

Reduce the revenue deficit to at least 0.5% of GDP each year and reduce the revenue deficit to 0.8% of GDP by 31 March 2023.

Hence, the claim that the Centre is introducing a law that requires CMs to pay the state's debts incurred during his/her tenure from their own assets is false.