Centre has not taxed schoolbooks; viral claims are false

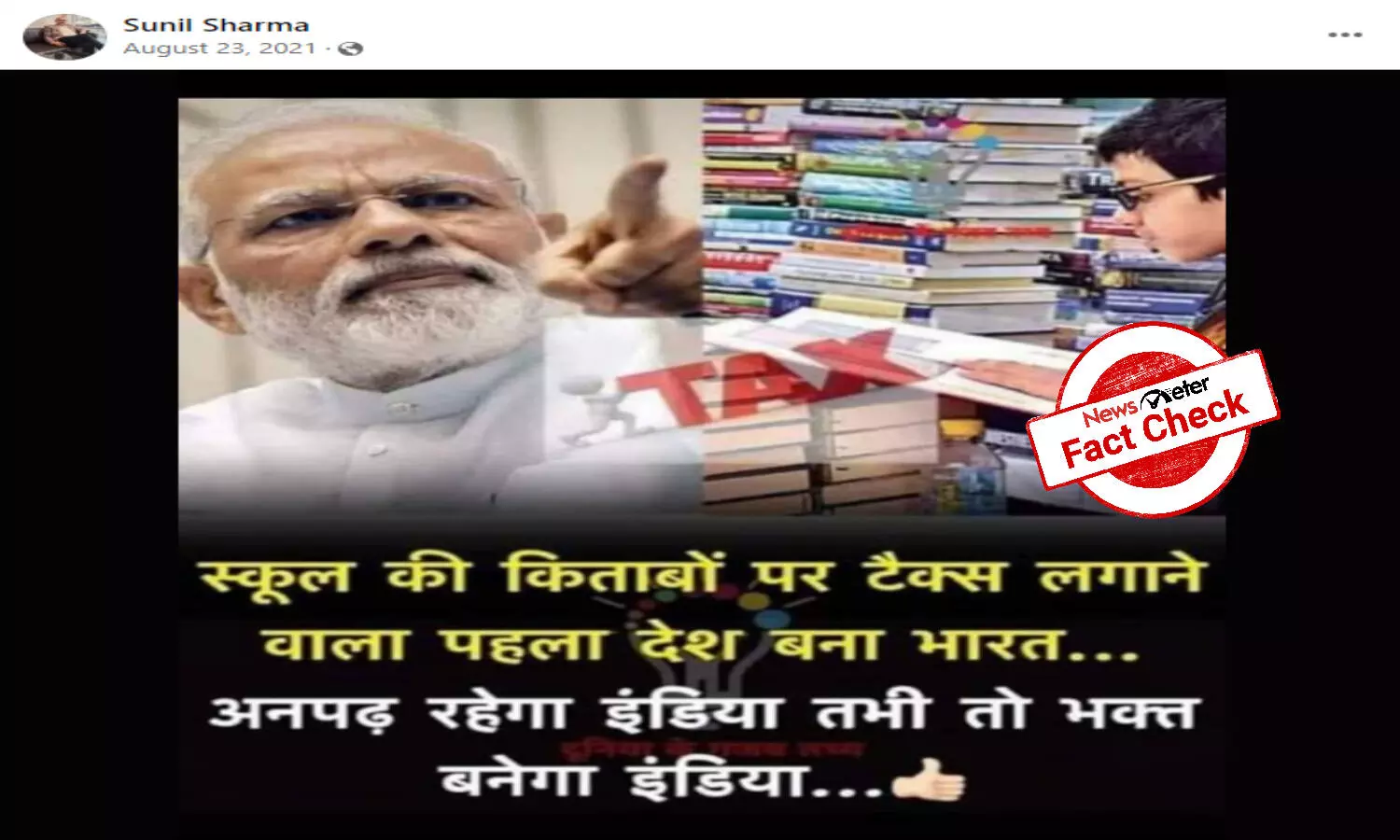

Social media users are claiming that the central government has levied a tax on schoolbooks.

By Newsmeter Network

Hyderabad: Social media users are claiming that the central government has levied a tax on schoolbooks.

Click here to view.

Fact Check:

The claim is false.

NewsMeter checked the official website of the Central Board of Indirect Taxes and Customs, Goods and Services and found that there is no exact mention of Goods and Services Tax (GST) on schoolbooks or school textbooks, GST on 'Printed books, including Braille books' (tariff item 4901); and on 'Children's picture, drawing or coloring books' (tariff item 4903) is zero.

https://cbic-gst.gov.in/gst-

However, the GST on Exercise books, graph books, & laboratory notebooks, and notebooks (tariff item 4820) is 12%.

Books are exempt from GST, but inputs such as printing, binding, and author royalties are subject to a 12% tax (rates vary according to rates of corresponding goods). Furthermore, no input tax credit is available to publishers, which many feared would lead to price increases.

As per the article, "the Authority of Advance Ruling (AAR) held that 12% of Goods and Service Tax (GST) applies to print and supply of textbooks to government departments which are registered under Goods and Services Tax (GST) Acts, 2017."

https://www.irro.org.in/no-

https://www.taxscan.in/12-gst-

When the same claim went viral on social media in 2020, PIB Fact Check confirmed that it was false via its Twitter account. "There is no tax on school textbooks."

दावा: सोशल मीडिया पर यह दावा किया जा रहा कि केंद्र सरकार ने स्कूली किताबों पर टैक्स लगा दिया है। #PIBFactCheck: यह दावा फर्जी है। स्कूली टेक्स्ट बुक्स पर कोई टैक्स नहीं है। pic.twitter.com/OsvfgYMOgC

— PIB Fact Check (@PIBFactCheck) September 24, 2020

Hence, the claim is false.