Do Hindu temples only come under the ambit of GST in India?

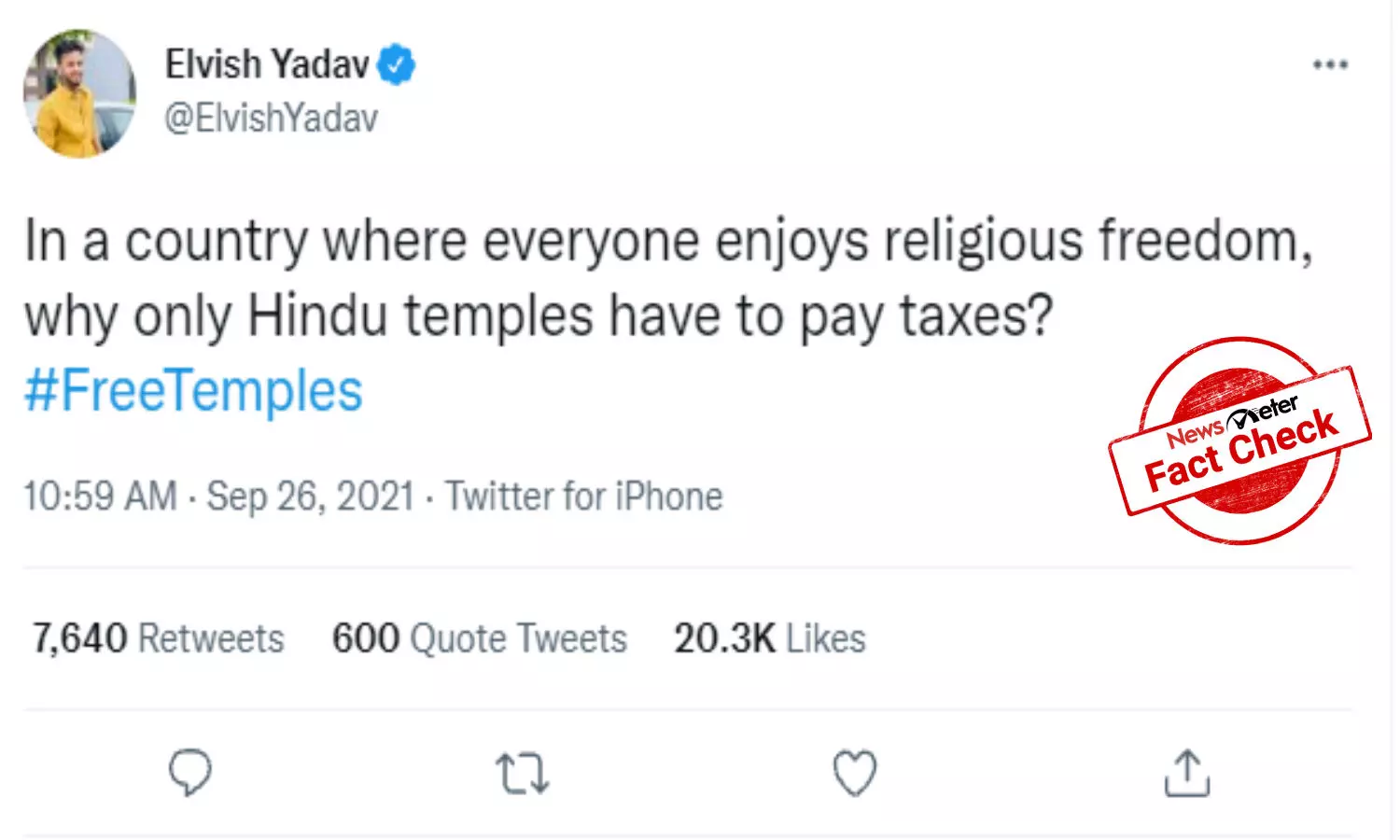

YouTuber Elvish Yadav has claimed that only Hindu temples have to pay taxes while other religious institutes are exempted from doing so.

By Newsmeter Network

HYDERABAD: YouTuber Elvish Yadav has claimed that only Hindu temples have to pay taxes while other religious institutes are exempted from doing so.

"In a country where everyone enjoys religious freedom, why only Hindu temples have to pay taxes," Yadav tweeted.

At the time of writing this report, the tweet has clocked over 20,000 likes and more than 7500 retweets.

In a country where everyone enjoys religious freedom, why only Hindu temples have to pay taxes? #FreeTemples

— Elvish Yadav (@ElvishYadav) September 26, 2021

FACT CHECK:

The claim is false.

In 2017, Press Information Bureau (PIB) put out a press release to debunk the claim. "There are some messages going around in the social media stating that the temple trusts have to pay the GST while the churches and mosques are exempt. This is completely untrue because no distinction is made in the GST Law on any provision based on religion. We request people not to start circulating such wrong messages on social media," PIB said

The same was also clarified by the Finance Ministry on its official Twitter account.

We request to people at large not to start circulating such wrong messages on social media.

— Ministry of Finance (@FinMinIndia) July 3, 2017

This is completely untrue because no distinction is made in the GST Law on any provision based on religion.

— Ministry of Finance (@FinMinIndia) July 3, 2017

There are some messages going around in social media stating that temple trusts have to pay the GST while the churches & mosques are exempt.

— Ministry of Finance (@FinMinIndia) July 3, 2017

Under Goods and Services Tax Rules, any business/body, religious or not, has to mandatorily register and are not exempted from service tax.

"The provisions relating to the taxation of activities of charitable institutions and religious trusts have been borrowed and carried over from the erstwhile service tax provisions. All services provided by such entities are not exempt. In fact, there are many services that are provided by such entities which would be within the ambit of GST," the rules said.

The rules list a few specifications of activities that are exempted from GST but this applies to all religions.

"This notification makes the exemption to charitable trusts available for charitable activities more specific. While the income from only those activities listed above is exempt from GST, income from activities other than those mentioned above is taxable. Thus, there could be many services provided by charitable and religious trusts which are not considered as charitable activities, and hence, such services come under the GST net. The indicative list of such services could be renting of premises by such entities, grant of sponsorship and advertising rights during the conduct of events/functions, etc," the rules said.

https://www.cbic.gov.in/

NewsMeter also reached out to some Charitable trusts and confirmed that they are following the prevalent tax laws in the country.

Evidently, it is clear that the claim that only Hindu temples pay taxes come under the ambit of GST is false.