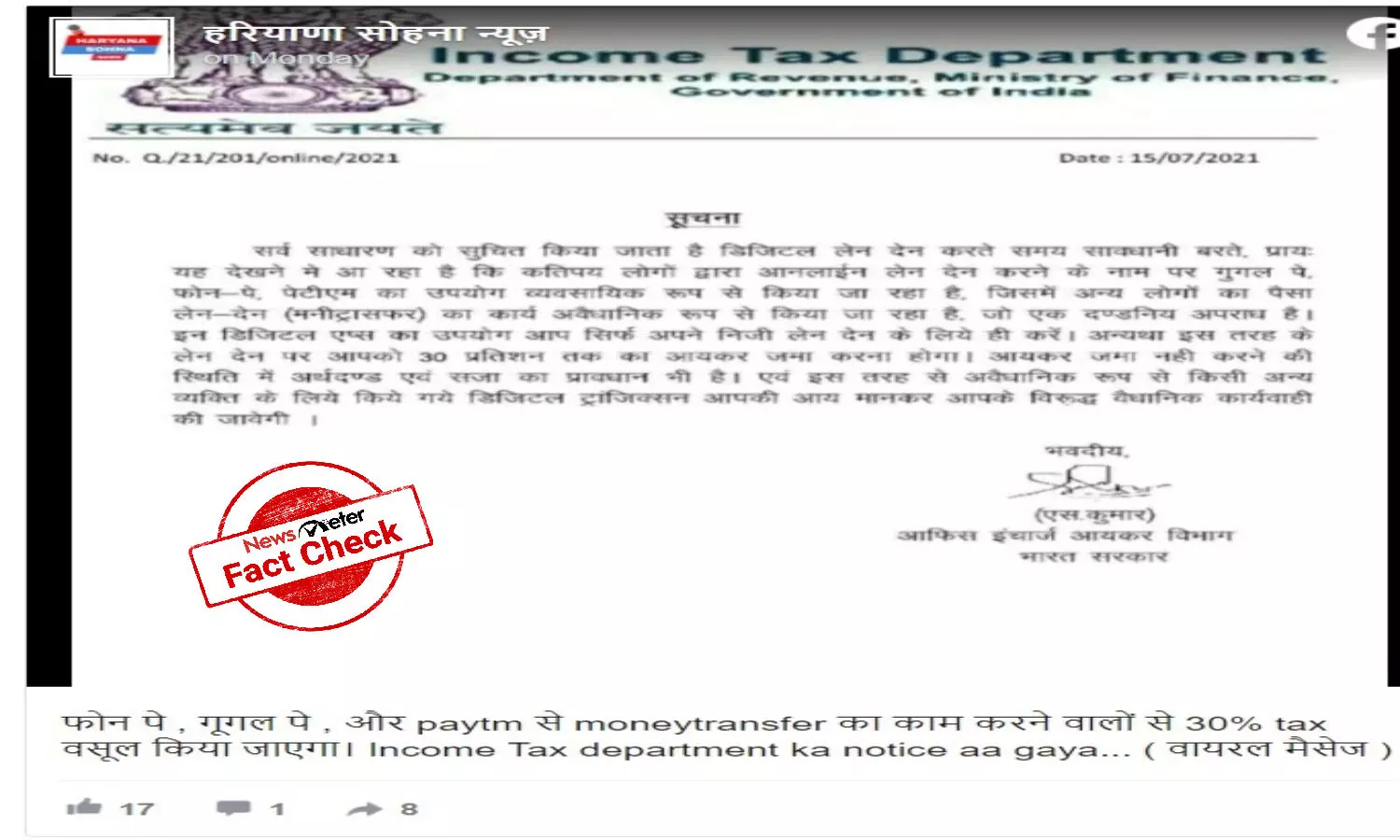

Hyderabad: A notice issued purportedly by Income Tax Department is viral on social media. Users claim that up to 30 percent tax will be levied on business transactions made through Google Pay, Paytm, and PhonePe. Failure to do so will result in fine and punishment.

In this notice dated July 15, 2021, people have been warned to use these apps only for personal transactions.

Click here to view the post.

Fact Check:

The claim is false.

If any such orders were issued by the Income Tax Department, mainstream media would have reported it. But, NewsMeter found no reports online.

The team found grammatical errors in the notice such as ऑनलाइन' written as 'आनलाईन, मनी टांस्फर' written as मनीट्रासफर', दण्डनीय' as दण्डनिय.

If this notice had been issued by the Income Tax Department, there would not have been such glaring mistakes.

Further, an Income Tax officer had refuted the viral claim. Quoting the officer, Aaj Tak said: "No rules like levying income tax of up to 30 percent on commercial money transfers made through UPI have been implemented. But it is true that income tax is levied on transactions above Rs 1 lakh through UPI."