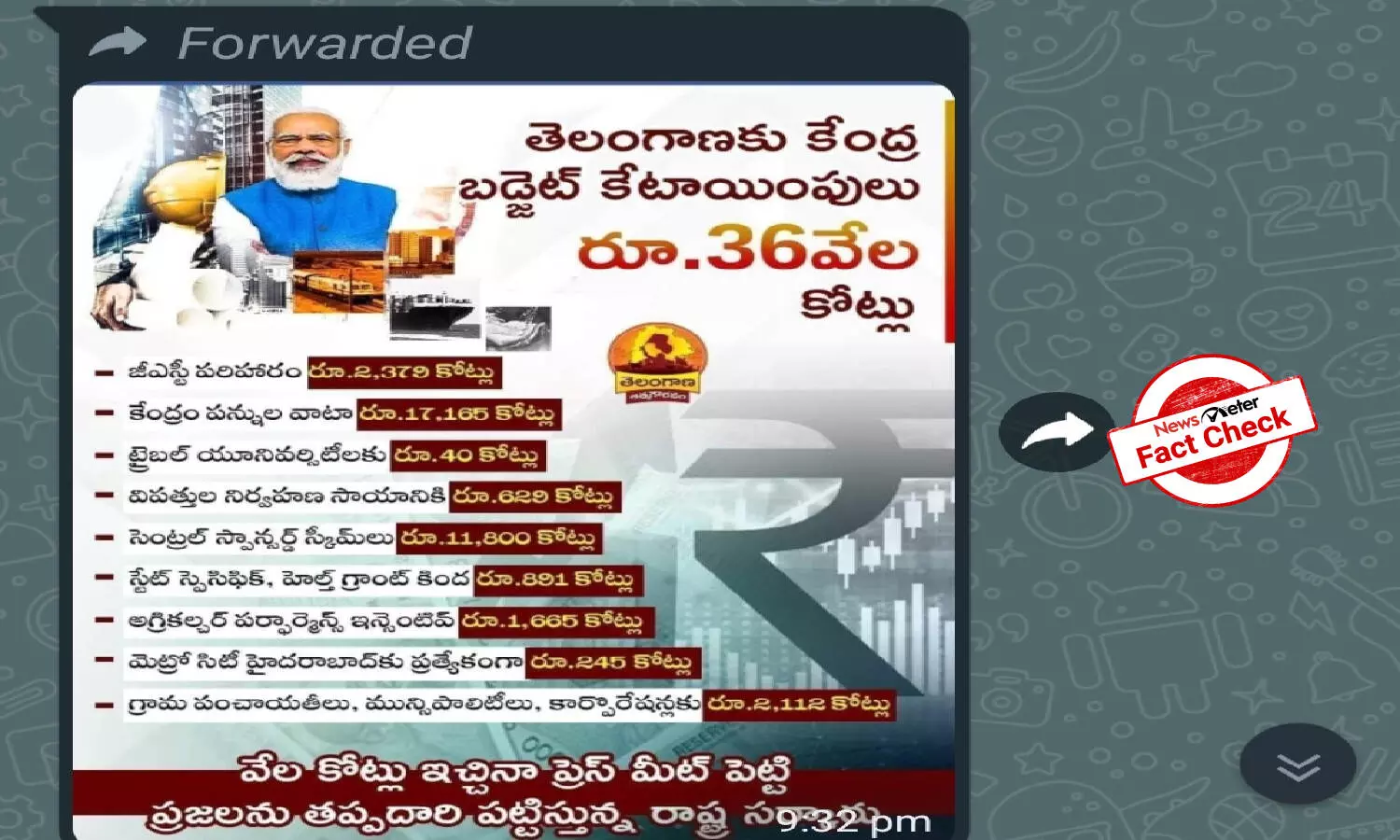

Has Centre earmarked Rs 36k crore for TS in union budget?

Social media users are claiming that the Centre has earmarked Rs 36,000 crore for Telangana in the recent budget.

By Newsmeter Network

Hyderabad: Social media users are claiming that the Centre has earmarked Rs 36,000 crore for Telangana in the recent budget. It includes GST compensation, the share of central taxes, disaster management assistance, and so on.

Click here to view.

NewsMeter received the claim on WhatsApp to verify it.

Fact Check:

In 2017, the 101st Amendment to the Constitution introduced the Service Tax ( GST ) Act. However, a provision has been included in the law stating that the revenue lost by the state governments due to the implementation of the Act will be borne by the Central Government for a period of five years. For which the Central Government will pay compensation to the States. (Insert pdf here- CGST act)

Part of this is allocating GST compensation to the states in the budget each year. The goods and services tax is revenue to the government so it is shown under revenue receipts and compensation to states under revenue expenditure. It is important to note, however, that GST compensation is a constitutional obligation of the Central Government. If the Goods and Services Tax (GST) Act had not been introduced, those revenues would have belonged to the states, so these would not have been allocated exclusively to the states.

The Constitution of India provides for the transfer of resources from the Center to the States to eliminate disparities between states. The constitution also mentions the methods by which central governments transfer resources to the states. However, it has set up a body called the Finance Commission under Article 280 to suggest proposals on how and in what form to make these resources. It is a constitutional body. It is established by the President every five years. The transfer of resources to the states is the responsibility of the Central Government.

Although the recommendations of the Finance Commission are not mandatory, governments generally implement most proposals in full or with some modifications. It is in this context that the share of central taxes in the central budget is set out, but it is not a separate allocation. Whoever is in power at the center should give a share in the taxes to the states.

https://fincomindia.nic.in/

Under Section 48 (1) of the Disaster Management Act, 2005, 75% of the State Disaster Response Fund ( SDRF ) available at the Commonwealth for Disaster Management shall be allocated by the Center and the remaining 25% by the State Governments. While 90% of the same special category states are allocated by the Center, the State Governments are allocated 10% by the State Governments.

https://ndmindia.mha.gov.in/

The law allocates funds to states for disaster management each year. These funds are the right of state governments. According to the constitution, it is the responsibility of the Centre to provide funding to the states.

According to the Panchayati Raj Act, the Central Government provides funds to the Gram Panchayats in the form of grants. However, it is the responsibility of the Central Government to provide grants to the Panchayats and this is clearly stated in the Constitution by law.

https://legislative.gov.in/

The 2022-23 budget does not specify how much will be allocated to each state, except how much is going to be spent by all states together on issues such as GST compensation and disaster relief assistance. So, as the post says, there is no evidence that Telangana has been allocated the amount in one form or another. Let's see below the rest of the topics mentioned in the post.

The Andhra Pradesh Reorganisation Act, 2014 states that at the time of the separation of Telangana and Andhra Pradesh in 2014, the Central Government would set up one Tribal University each in the state of Telangana and Andhra Pradesh. Against this backdrop, Rs 40 crore has been allocated in the 2022-23 budget to set up tribal universities in Andhra Pradesh and Telangana. However, the budget allocates this amount to the two states together, but it is not clear how much for each state.

The 2022-23 budget does not specify how much is going to be spent on centrally sponsored schemes for the state of Telangana except to mention the net expenditure of all the states together under various schemes for centrally sponsored schemes. So there is no evidence for the argument being posted.

Although this budget allocates funds in the form of grants to the health sector, it does not specify how much is allocated to any state. So there is no evidence that Telangana has been allocated grants of Rs 891 crore.

The 2022-23 budget does not specify how much is going to be spent on centrally sponsored schemes for the state of Telangana except to mention the net expenditure of all the states together under various schemes for centrally sponsored schemes.

Hence, the claim is misleading.

There is no conclusive evidence about the allocation made in Union Budget for Telangana.