Kin of employees, who die of COVID-19, eligible for reimbursement under EDLI

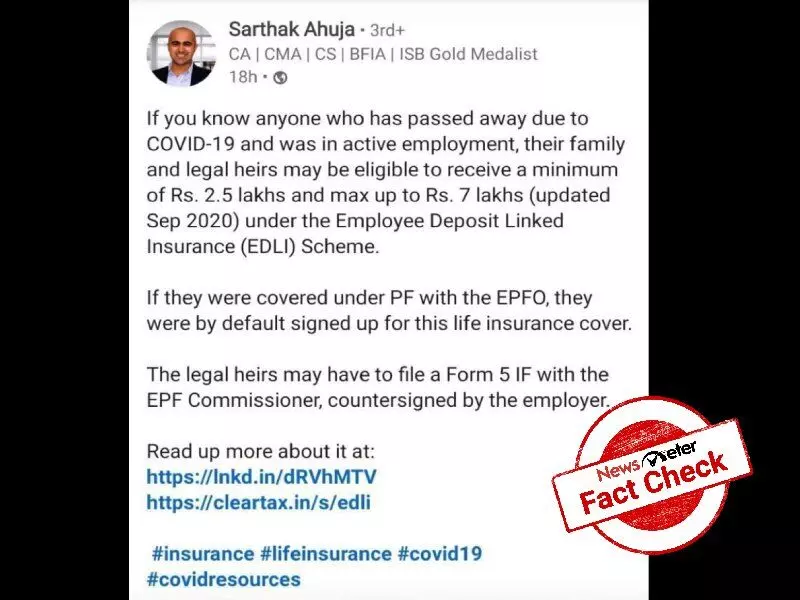

A screenshot of a post by ISB Gold Medalist Sathark Ahuja is being shared on Facebook with a claim that if someone with active employment passes away due to COVID-19, his or her heirs are eligible to receive money under the EDLI scheme.

By Satya Priya BN

A screenshot of a post by ISB Gold Medalist Sathark Ahuja is being shared on Facebook with a claim that if someone with active employment passes away due to COVID-19, his or her heirs are eligible to receive money under the EDLI scheme.

"If you know anyone who has passed away due to COVID-19 and was inactive employment, their family and legal heirs may be eligible to receive a minimum of Rs. 2.5 lakhs and max up to Rs. 7 lakhs (updated Sep 2020) under the Employee Deposit Linked Insurance (EDLI) Scheme. If they were covered under PF with the EPFO, they were by default signed up for this life insurance cover. The legal heirs may have to file a Form 5 IF with the EPF Commissioner, countersigned by the employer," reads the message.

Read up more about it at:

#insurance #lifeinsurance #covid19 #covidresources"

Archive links:

https://web.archive.org/save/%

Fact Check:

The claim that if someone with active employment passes away due to COVID-19 and his or her heirs are eligible to receive money under the EDLI scheme is TRUE.

India's retirement fund manager – Employees Provident Fund Organisation raised the death insurance benefits for subscribers of its employees' deposit-linked Insurance (EDLI) scheme, at a time the coronavirus pandemic wreaks havoc across the country.

In a gazette notification, the Employees' Provident Fund Organisation (EPFO) said the minimum death insurance has been increased to ₹2.5 lakh and the maximum to ₹7 lakh, from the earlier limits of ₹2 lakh and ₹6 lakh, respectively.

https://www.epfindia.gov.in/

http://www.epfindia.nic.in/

Speaking on the PF withdrawal rules for medical treatment, SEBI registered tax and investment expert Jitendra Solanki said: "A PF/EPF account holder is allowed for withdrawal, in the case of a medical emergency. But, remember, a medical emergency for PF withdrawal means a critical illness that attracts a high cost of treatment."

The membership of EDLI is automatically provided to those covered in EPF. The Employees' Deposit-Linked Insurance Scheme, 1976 provides an insurance cover to be paid to the employee's nominee on the death of the employee during employment. The claim amount is linked to the average of the provident fund account balance of an employee and is payable to the nominee of the employee. As the EDLI scheme applies to all employees under the Employees' Provident Funds and Miscellaneous Provisions Act, 1952, there is no need to add the nominee separately.

As an employee, one needs not to pay but only the employer has to contribute. Up to the maximum wage ceiling of Rs 15,000, the employer has to contribute 0.5 percent of the employee's wages along with administrative charges.

Therefore, if someone with active employment passes away due to COVID-19, his or her heirs are eligible to receive money under the EDLI scheme is TRUE.