Old news about banks writing-off loans of defaulters shared as recent

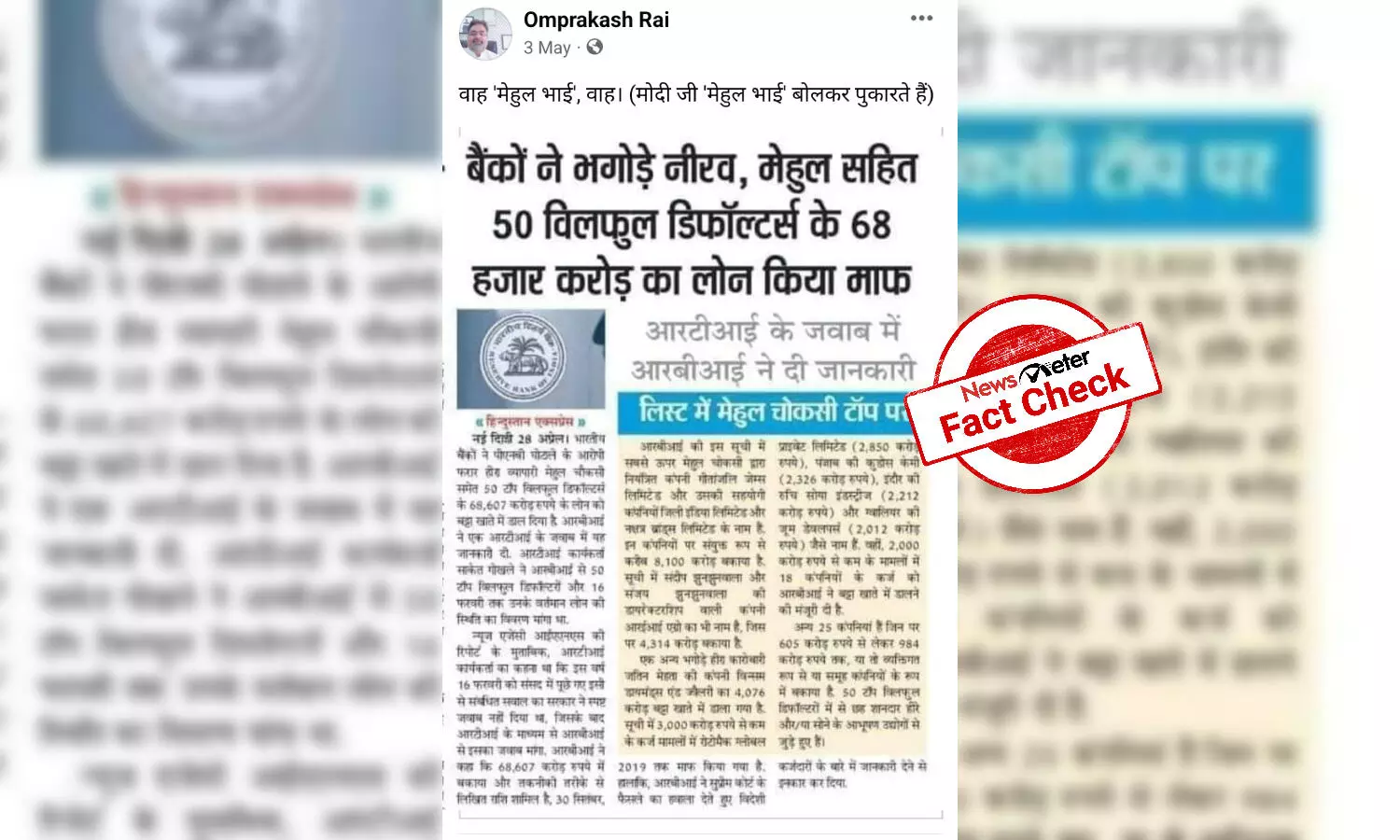

Social media users are claiming that banks have waived off Rs 68,000 crore loans of 50 wilful defaulters. They include fugitive Nirav Modi and Mehul Choksi.

By Newsmeter Network

Hyderabad: Social media users are claiming that banks have waived off Rs 68,000 crore loans of 50 wilful defaulters. They include fugitive Nirav Modi and Mehul Choksi. Users are sharing a Hindi newspaper clip to substantiate the claim.

Click here to view.

Fact Check:

The claim is misleading.

NewsMeter conducted a reverse image search. We found that several news agencies have reported the news some time back. Viral news clip is also one item.

Responding to a query filed by activist Saket Gokhale, RBI released the list of the top-50 wilful defaulters. The list includes firms belonging to Nirav Modi, Mehul Choksi, and Vijay Mallya.

Congress leader shared a copy of the RTI response on Twitter.

बैंक लुटेरों द्वारा पैसा लूटो-विदेश जाओ-लोन माफ कराओ ट्रैवल एजेंसी का पर्दाफाश!

— Randeep Singh Surjewala (@rssurjewala) April 28, 2020

भगोड़ो का साथ-भगोड़ो का लोन माफ बना है BJP सरकार का मूलमंत्र

लघु उद्योग,दुकानदारी,व्यवसाय ठप्प हो गए,

पर इसके बावजूद मोदी सरकार द्वारा बैंक डिफॉल्टरों को ₹68,607Cr की माफी दी जा रही है

हमारा बयान: pic.twitter.com/j7CyKVUTqx

However, it is noteworthy to mention that banks did not waive off these loans but write them off. As per RBI, writing-off just clears the bad loans from the balance sheets. However, these bad accounts continue to stay in the books and the banks try to recover these loans by other means.

https://m.rbi.org.in//Scripts/

Writing off a loan is a general practice implemented by banks to clean up their balance sheets. In the case of a write-off, the lending banks clean up the bad loans from their balance sheet. However, the loan account still stays to continue with the lending bank as they can try to recover it later on. Moreover, if any collateral is attached to the loan, then the lender confiscates them.

Whereas in the case of loan waive-off, the lender completely cancels the account, and the borrower is free from the debt. If any collateral is linked to the debt, then it will be returned to the borrower. Thus the banks have just written off these bad loans and did not completely waive them as claimed in the post.

85% of the total defrauded funds have been attached/seized in the case of Mallya, Modi & Choksi

Further, the Enforcement Directorate (ED) has recently said Vijay Mallya, Nirav Modi and Mehul Choksi have defrauded Public Sector Banks which resulted in a total loss of Rs. 22,585.83 Crore. The ED said that assets worth Rs. 19,111.20 crore have been attached under the provisions of PMLA. Out of which, assets worth Rs.15,113.91 crore have been restituted to the Public Sector Banks. In other words, 84.61% of the total defrauded funds in these cases have been attached/seized and 66.91% of the total loss has been handed over to Banks.

https://

Hence, the claim is misleading.