Fake news alert: UPI transactions over Rs. 2000 will not attract 1.1% fee

NPCI clarified bank account-to-account UPI transactions will remain free for customers and merchants.

By Md Mahfooz Alam

(Source: Twitter/@INCKerala)

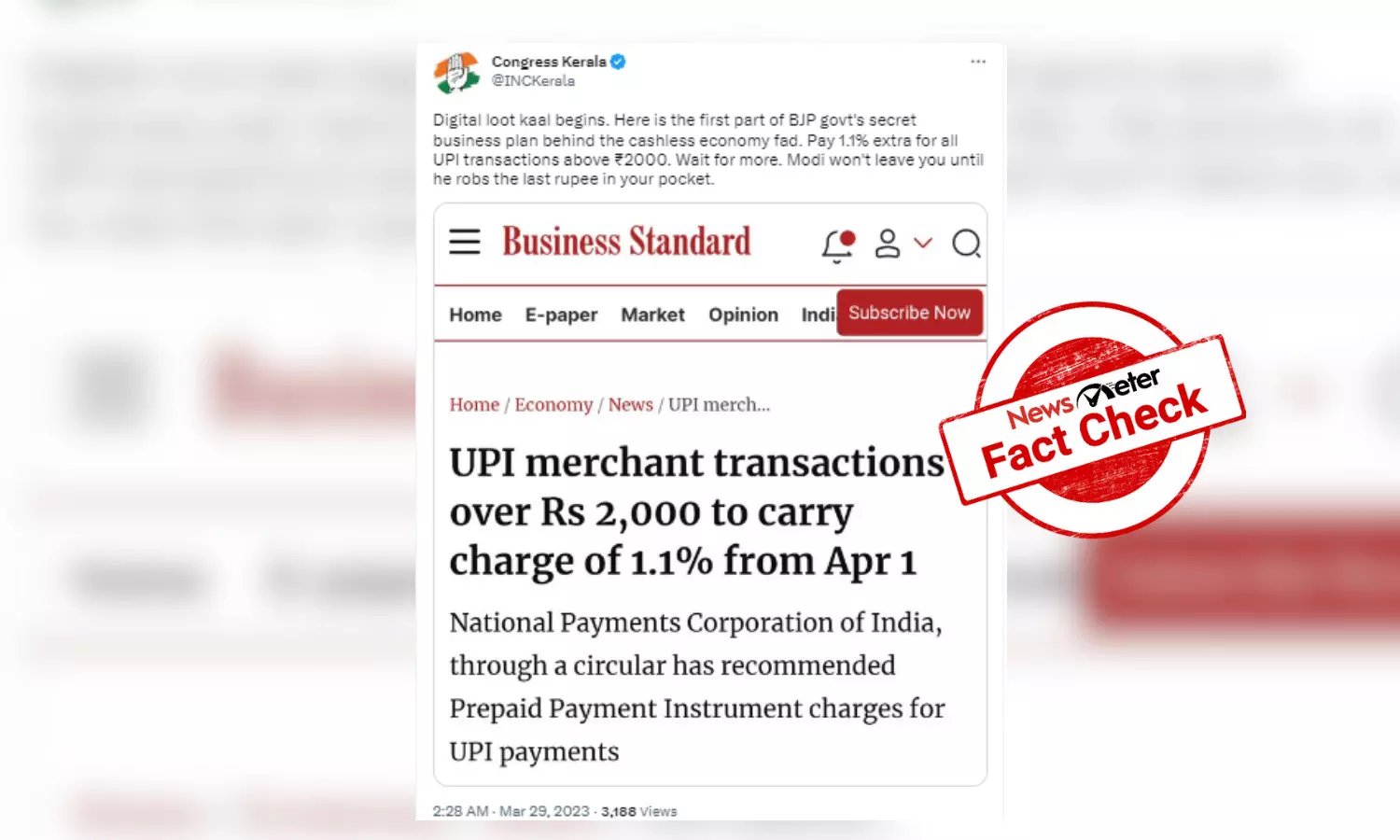

On 29 March, several social media users and media outlets claimed that Unified Payments Interface (UPI) is no longer free and a 1.1 percent fee will be charged to all its customers for transactions of Rs. 2000 or above.

(Source: Twitter/@INCKerala)

Fact Check

NewsMeter found that the claim is misleading.

National Payments Corporation of India (NPCI) tweeted a clarification on 29 March. In a press release, it said bank account-to-account UPI transactions will remain free for customers and merchants.

It further clarified that interchange charges introduced are only applicable for Prepaid payment instruments (PPI) merchant transactions.

NPCI Press Release: UPI is free, fast, secure and seamless

— NPCI (@NPCI_NPCI) March 29, 2023

Every month, over 8 billion transactions are processed free for customers and merchants using bank-accounts@EconomicTimes @FinancialXpress @businessline @bsindia @livemint @moneycontrolcom @timesofindia @dilipasbe pic.twitter.com/VpsdUt5u7U

PIB Fact Check, in a thread, called out media outlets such as India Today, TV9 Gujarati, Business Today, and Navbharat Times and clarified that normal UPI transactions would not attract any charges.

.@IndiaToday claims that UPI transactions over Rs 2000 will be charged at 1.1%#PIBFactCheck

— PIB Fact Check (@PIBFactCheck) March 29, 2023

➡️There is no charge on normal UPI transactions.

➡️@NPCI_NPCI circular is about transactions using Prepaid Payment Instruments(PPI) like digital wallets. 99.9% transactions are not PPI pic.twitter.com/QeOgfwWJuj

Paytm also took to Twitter to dismiss the misleading claim. It said no customers would have to pay any charges for making payments from UPI either from the bank account or PPI/Paytm Wallet.

Regarding NPCI circular on interchange fees & wallet interoperability, no customer will pay any charges on making payments from #UPI either from bank account or PPI/Paytm Wallet. Please do not spread misinformation. #Mobile payments will continue to drive our economy forward!

— Paytm Payments Bank (@PaytmBank) March 29, 2023

Hence, we conclude that the claim that UPI transactions over Rs. 2000 will attract a 1.1 percent fee is misleading.