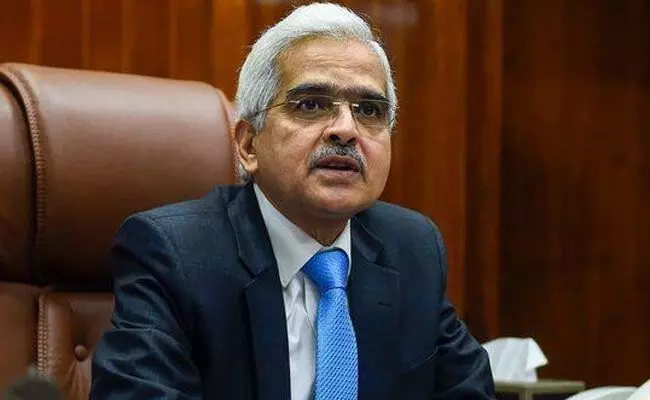

Rs 2,000 notes withdrawal will have ‘very marginal’ impact on economy: RBI Governor

The RBI governor appealed to the public not to rush to the banks as there are still four months till the deadline, and the notes will continue to be legal tender

By Newsmeter Network

New Delhi: Reserve Bank of India (RBI) Governor Shaktikanta Das said most of the withdrawn Rs. 2,000 banknotes are expected to be returned by the deadline of 30 September.

Speaking to reporters for the first time since the surprise decision to withdraw the highest denomination currency note was announced, Mr. Das said the decision was part of currency management. Rs. 2,000 currency notes will continue to be legal tender, he added.

“The Indian currency management system is very robust, and the exchange rate has remained stable despite the crisis in financial markets due to war in Ukraine and the failure of certain banks in the West,” said the RBI Governor.

The impact of the withdrawal on the economy will be “very very marginal,” he said, adding Rs. 2,000 currency notes made up for just 10.8% of the total currency in circulation.

He said Rs. 2,000 notes were introduced primarily to replenish the currency that was withdrawn following the 2016 demonetisation.

While the withdrawn Rs. 2,000 notes can either be deposited in bank accounts or exchanged for other currency, banks have been advised to make necessary arrangements for exchange, the RBI Governor said.

‘Do not rush to banks’

The RBI governor appealed to the public not to panic and rush to banks as there are still four months till the deadline. As the notes will continue to be legal tender, there is no bar on Rs. 2,000 notes. Shops cannot refuse to accept the notes from customers.

“We expect most of Rs. 2,000 banknotes to come back to the exchequer by 30 September. We have more than adequate quantities of printed notes already available in the system, not just with RBI but with currency chests operated by banks. There is no reason to worry. We have sufficient stocks, no need to worry,” he said.

The RBI said it was sensitive to difficulties faced by the people and will come out with regulations if need be.

The existing Income Tax requirement of furnishing PAN for deposits of Rs. 50,000 or more in bank accounts will continue to apply for deposits of the withdrawn Rs. 2,000 notes, said Mr. Das.

Mr. Das said liquidity in the system is being monitored on a daily basis.

Inputs from PTI