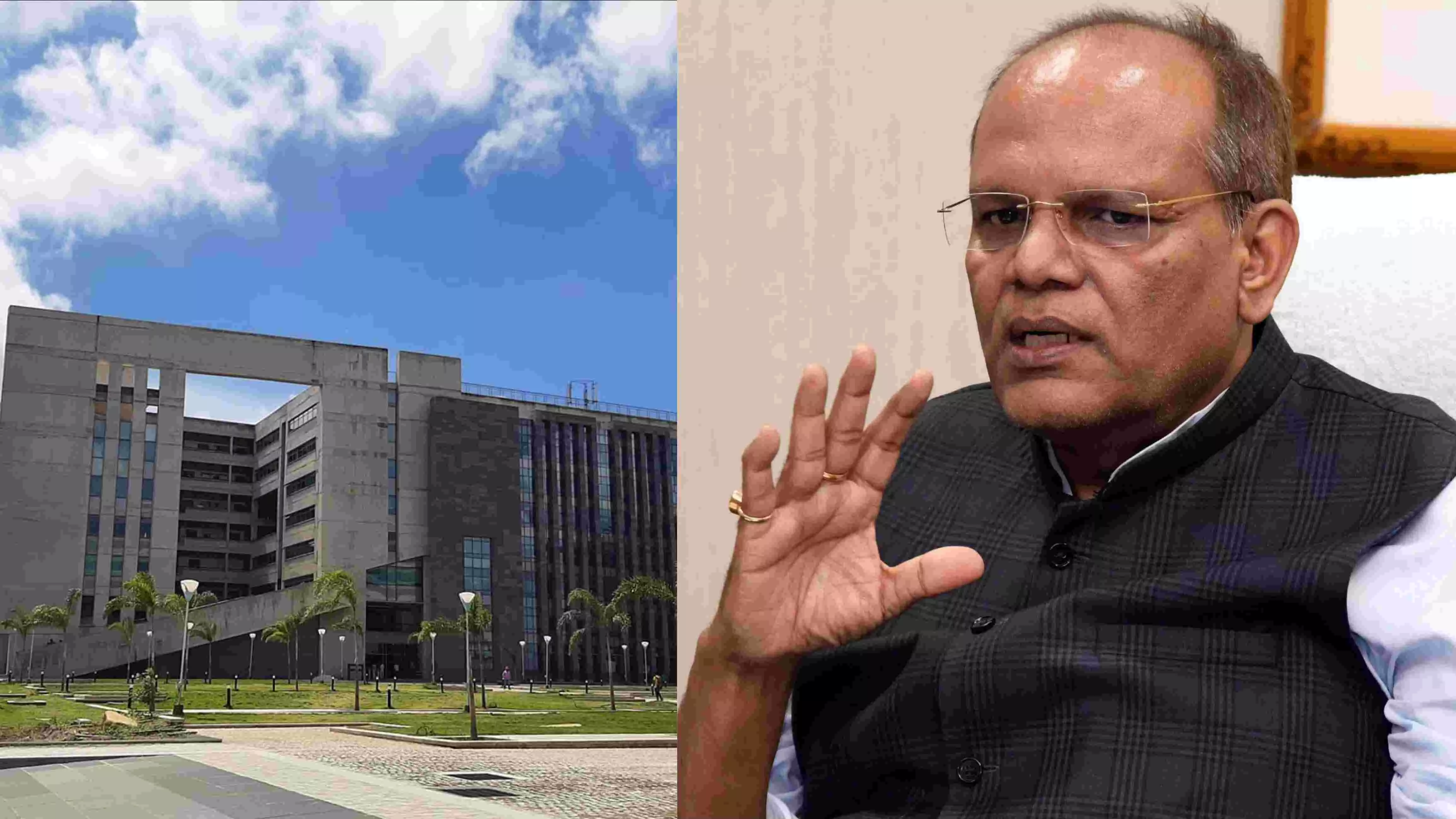

Somesh Kumar, IIT Hyderabad Professor booked in Rs 1000 Cr GST violation case

An officer, who is a primary complainant, alleged a criminal conspiracy including masking data related to taxpayers

By Coreena Suares

Hyderabad: Telangana State Commercial Tax Department (TSCTD) has unearthed a Rs 1000 crore input tax credit scam involving 75 companies including State Beverages Corporation.

A case has been registered against former Chief Secretary Somesh Kumar; former Commercial Tax officers, S V.Kasi Visweswara Rao and A. Siva Rama Prasad; IIT Hyderabad Assistant Professor Sohan Babu; and Plianto Technologies.

Police have registered the case under section 406, 409, and 120B of IPC and the IT Act following a forensic audit revealing software changes linked to a former IAS officer who served in the highest office of the state’s administration. The cops registered a case based on a complaint filed by K. Ravi Kanuri, Joint Commissioner (CT), Central Computer Wing, Commercial Tax Department.

How did the scam unfold?

It all began when the Telangana State Commercial Tax Department noticed a GST fraud committed by Big Leap Technologies and Solutions Private Limited.

The companies engaged/ dealing in manpower supplies and passed on an Input Tax Credit worth Rs.25.51 crore without actually paying any tax to the government, leading to a loss to the state exchequer.

Before the scam surfaced, the State Commercial Tax Department had hired professionals from IIT-Hyderabad as service providers for the development of Software for the Commercial Taxes Department. The role of the service provider was to perform analytics and report various kinds of discrepancies based on the returns filed by the taxpayers registered in Telangana, according to the contract.

Pertinently, the discrepancy figured during the desk audit of Big Leap Technologies and Solutions Private Limited. There was a basic discrepancy. However, it did not appear in the reports generated through the `Scrutiny Module’ developed by IIT- Hyderabad, the complaint said.

What did the investigation lead to?

A thorough investigation was carried out by internal staff. Initially, an officer from the department visited IIT-Hyderabad. Later, he submitted a report highlighting various lacunas including non-documentation of changes made to the software, changes in applications being done on oral instructions from the then Special Chief Secretary, Revenue(CT), Additional Commissioner (ST), (IT & EIU), S.V. Kasi Visweswara Rao, and Deputy Commissioner(ST), STU-1, Hyderabad Rural, Siva Rama Prasad and others.

The officer also found that the `Scrutiny Reports’ did not capture the IGST discrepancies, leading to a loss of revenue.

Following these loopholes, the department's top brass called for an explanation from the then Additional Commissioner (ST), (IT & EIU) S.V. Kasi Visweswara Rao, and Deputy Commissioner (ST), STU-1, Hyderabad Rural Siva Rama Prasad. Besides these two officials, an explanation was also sought from Plianto Technologies Private Limited, because this company was maintaining operations of the Commercial Taxes Department on the premises of IIT-Hyderabad.

What did the explanation reveal?

When the company and the officers were asked for an explanation, they said they were operating (functioning) on the instructions of former Chief Secretary Somesh Kumar.

According to FIR, during the operations, a format was given to IIT-Hyderabad for pinpointing all four discrepancies including IGST, CGST, SGST, and Cess. They (IIT Hyderabad) were not aware of why IGST and Cess notices were not generated. Plianto Technologies Private Limited denied developing any software for the Commercial Taxes Department, the report said.

Furthermore, when the contract agreement between the Commercial Tax department and IIT was audited by an independent audit department, it was found a lack of specifications, timelines, delivery dates, lack of clarity in payment terms, said an FIR accessed by NewsMeter.

Investigators identified eleven cases, which were masked by IIT-Hyderabad. They had evasion of more than Rs. 400 crore. One such masked case pertained to Telangana State Beverages Corporation Limited. Furthermore, evasion of more than Rs. 1000 crore was unearthed through fraudulent cases detected in the State.

An officer, who is a primary complainant, alleged a criminal conspiracy. These include masking data related to taxpayers, issuing instructions not to cancel fraudulent cases, estimating IGST losses but not including IGST in issued notices, and sharing proprietary data of the Commercial Taxes Department with a third party.

Additionally, the complainant highlighted unauthorized changes in taxpayer jurisdiction to favor certain individuals, including those who received favorable advance rulings.

The officer also mentioned that employees of Plianto Technologies Private Limited were claiming to be on the rolls of IIT-H, with which the Commercial Taxes Department had an agreement. The possibility of pecuniary benefits accruing to the individuals involved cannot be ruled out.