Lockdown: Cab drivers spend sleepless nights as loan deadline gets nearer

By Newsmeter Network

Hyderabad: App-based cab drivers are spending sleepless nights as the deadline for paying interest draws near.

Though the government has imposed three months moratorium on EMI’s, the app-based taxi drivers are worried about the interest which they shall have to pay in June after the end of the deadline.

A survey conducted by the Indian Federation of App-based Transport (IFAT) revealed that around 51% of the drivers have taken loans from co-operative banks, while others have borrowed from different financial companies.

Around 6500 app-based taxi drivers were surveyed in 15 states across the country. “The government has only given moratorium on EMI payment. What about the compound interest we would have to pay immediately after June,” said Imran Khan, a driver from Lucknow.

The drivers also stated they had also taken fresh loans to sustain in the lockdown. “It will take many months for the drivers to repay the loans taken during the lockdown. The government needs to acknowledge this and help the drivers,” says Kamaljeet Singh, Vice President of IFAT.

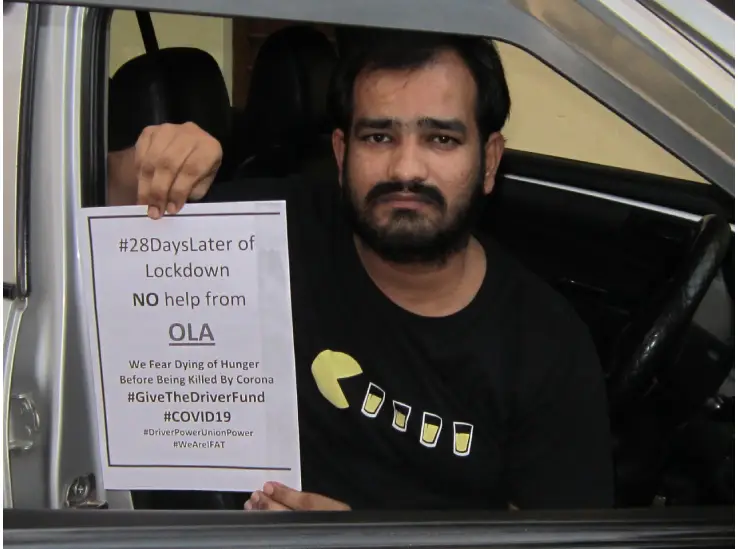

Drivers said Ola and Uber are providing monetary benefits but the procedure is not transparent and the relief is not reaching everyone.

“It is being communicated to the drivers telephonically to repay the loans after the lockdown,” said a driver requesting anonymity.

Uber has also transferred Rs.3000 to some drivers as a part of the relief. “There is no transparency. We don’t know on what basis they are giving loans,” said National General Secretary of IFAT Shaik Salauddin

According to Uber, they have helped around 55000 drivers. However, drivers said the number is too less given the total roll in the company.